Each time history repeats itself, the price goes up

Ronald Wright

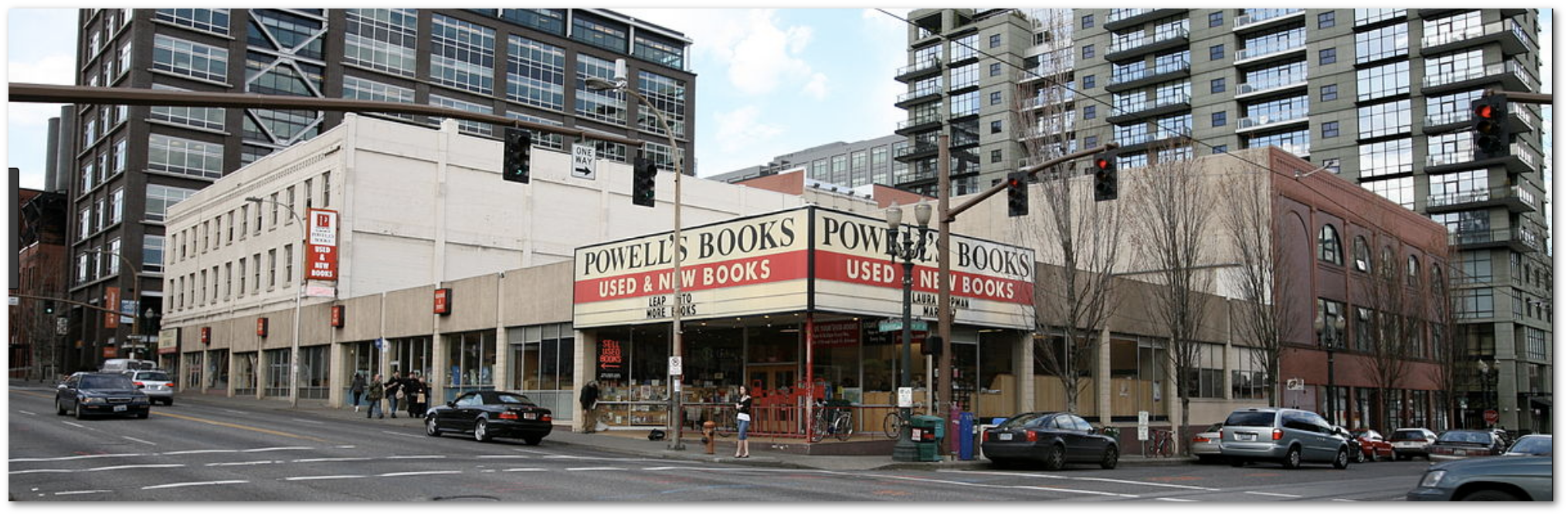

I was in Portland, Oregon recently and went to the most fantastic of book stores - Powell’s City of Books. If I hadn’t had another purpose for being in Portland, I think I would have spent the entire week there.

Occupying a city block and with

over one million new and used books, there is something for everyone - even an

Austrian Economics geek like me. While they didn’t dedicate a whole floor to

the Austrian School (I know, what were they thinking?!) I did walk away with an

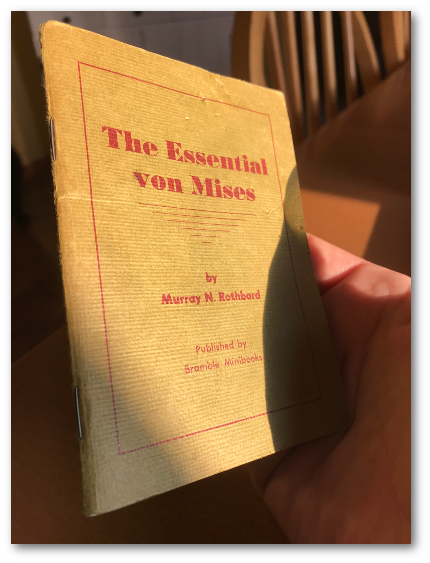

awesome 60-page minibook by Rothbard, The Essential von Mises.

Occupying a city block and with

over one million new and used books, there is something for everyone - even an

Austrian Economics geek like me. While they didn’t dedicate a whole floor to

the Austrian School (I know, what were they thinking?!) I did walk away with an

awesome 60-page minibook by Rothbard, The Essential von Mises.

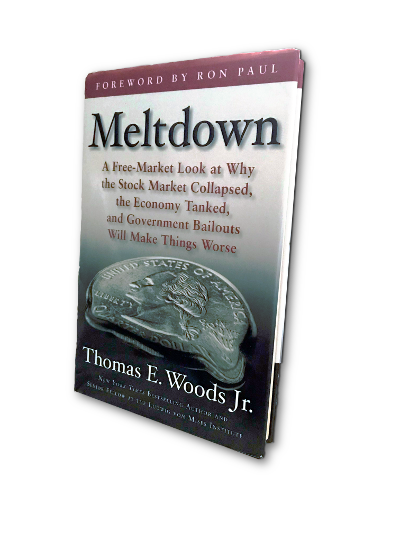

Back in Ohio, inspired by Powell’s, I looked for local used bookstores in the

hope that I would find more little treasures. I was fortunate enough to walk

into a tiny place crammed with 50,000+ used books - and having an inventory

reduction sale. I picked up Tom Woods’ Meltdown for a mere $3.00. What a

bargain!

Back in Ohio, inspired by Powell’s, I looked for local used bookstores in the

hope that I would find more little treasures. I was fortunate enough to walk

into a tiny place crammed with 50,000+ used books - and having an inventory

reduction sale. I picked up Tom Woods’ Meltdown for a mere $3.00. What a

bargain!

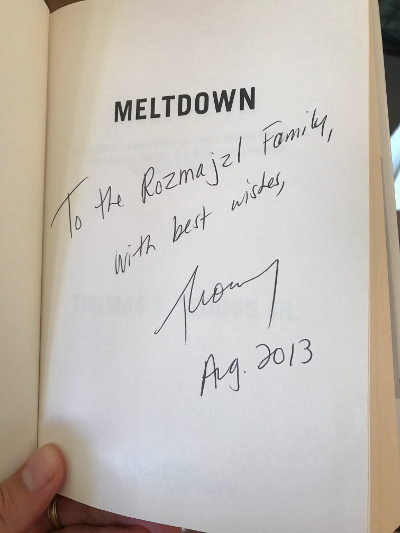

I already have a signed copy of the book at home. However, if you’re

sharing this stuff with friends like I am - and you should be sharing this with

friends - having another copy to pass around helps to “scale” Tom’s influence.

I already have a signed copy of the book at home. However, if you’re

sharing this stuff with friends like I am - and you should be sharing this with

friends - having another copy to pass around helps to “scale” Tom’s influence.

Tom famously got this book on the market in record time mere months after the 2008 financial crisis became evident. In doing so he beat the Keynesian-statist “experts” (a la Paul Krugman) to the punch. And if reading the book so soon after the bust was cool, reading it right before the next one might prove even cooler(?). I’ll be giving it another look over the next week.

Anyone who cares should be prepared for the coming bust that is certain to make the 2008 crisis look like child’s play in comparison. For sure we’ll hear the same tired and inane rants against some cartoonish concept of “the market” or “capitalism”.

These deserve a swift and thorough smackdown delivered with a razor-sharp exposition of the real causes. Against the inevitable whining for more state intervention, the Austrian should be ready to make the case for alternative and real free-market prescriptions.

The dirty details of the next bust are sure to look different from those of a decade ago. What is no less certain is that, thanks to books like Meltdown, clear-thinking Austrians will be able to trace concisely from the numerous “symptoms” - probably masquerading as causes - back to the ultimate cause - the Federal Reserve and its insidious policy of monetary expansion.

Leave a comment